You’ve packed your bags, mapped out your next adventure, and your laptop is ready for another remote work session in some exotic location. Everything is set, right? Well, maybe not.

One thing we often overlook is digital nomad health insurance. I get it—who wants to think about worst-case scenarios when you’re busy planning epic trips and exciting experiences? But here’s the thing: accidents happen, even when you’re sipping out of coconuts on a beach.

I once found myself in a sticky situation while hiking in Bali—slipped, twisted my ankle, and suddenly I needed a doctor in a foreign country. I didn’t have proper coverage, and let’s just say the bill was as painful as the injury. This is why having health insurance as a digital nomad is non-negotiable.

In this article, I’ll walk you through everything you need to know, from the different types of insurance to how to pick the right plan for you.

Table of Contents

1. Why Health Insurance is Essential for Digital Nomads

Let’s be real: being a digital nomad is an adventure, but adventure comes with risks. Whether it’s falling off a scooter in Thailand or getting food poisoning in Mexico, health mishaps don’t care how awesome your Instagram feed looks. And if you’re hopping between countries like I do, each place has its own set of healthcare costs—and let me tell you, they can add up.

Some countries even require proof of health insurance for entry, especially if you’re staying long-term. Imagine landing in your dream destination, only to be turned away at immigration because you didn’t get insured, definite nightmare!

2. Types of Health Insurance for Digital Nomads

When it comes to health insurance, it’s not one-size-fits-all, especially for digital nomads. You’ve basically got two main options: travel insurance or long-term health insurance.

Travel insurance is great for short-term needs, like covering emergency hospital visits or accidents. I mean, if you break your arm surfing in Bali, you’ll want that hospital bill covered. But here’s the thing: travel insurance usually doesn’t cover ongoing treatments or regular check-ups. It’s more of a Band-Aid solution (pun intended!).

Long-term health insurance, on the other hand, is more comprehensive. It covers you wherever you go, and many plans even allow you to get regular care, like dental check-ups or therapy. But, of course, these plans tend to cost more. I learned the hard way after using a cheap travel insurance plan that didn’t cover my sprained ankle follow-up care. Lesson learned!

3. Top Providers of Digital Nomad Health Insurance

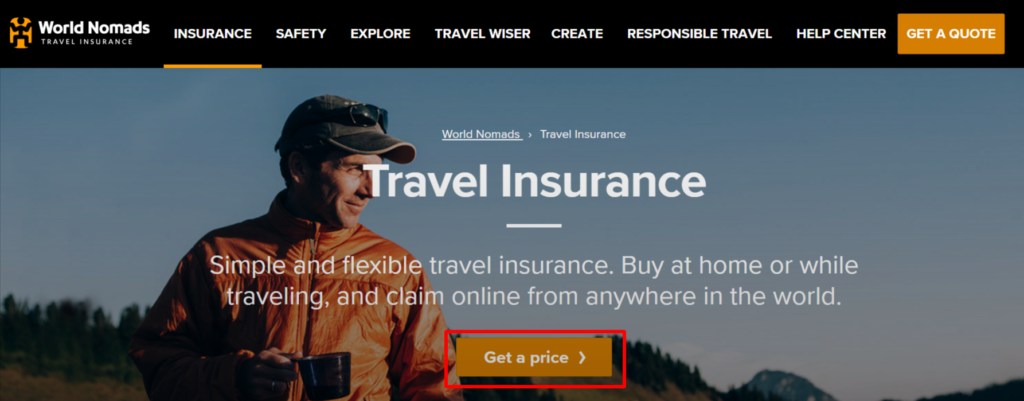

Now, let’s talk about the top players in the digital nomad health insurance game. Allianz Travel, SafetyWing, and World Nomads are all big names you’ll hear thrown around. Each has its pros and cons depending on your needs.

Allianz Travel is great for short trips or annual plans, and they’re known for solid emergency coverage. If you’re moving around a lot, SafetyWing is pretty affordable and covers most emergencies, plus some general healthcare. Then there’s World Nomads, which covers more adventurous travelers—perfect for those of us who dabble in risky sports like scuba diving or snowboarding.

I personally went with SafetyWing after reading about a friend’s smooth claim process when they had a nasty accident in Portugal. No headaches, just fast coverage—exactly what you need when you’re far from home.

4. Key Factors to Consider When Choosing a Plan

Okay, so how do you choose the right health insurance plan for your digital nomad lifestyle? First up, consider the coverage area. Some plans cover you worldwide, while others limit coverage to certain regions. If you’re like me and change countries every couple of months, make sure you’re covered globally.

Cost is the next biggie. Health insurance can be pricey, so weigh the premium against what you actually need. Are you staying put in one place for a while? Maybe a cheaper plan is enough. But if you’re always on the move, a higher premium might save you down the road. And then there’s the fun topic of pre-existing conditions—some plans won’t cover them, so if you’ve got a medical history, you’ll want to read the fine print.

Lastly, look at how easy it is to file a claim. You don’t want to deal with a nightmare insurance company that requires forms in triplicate when your intestines are doing the samba. Trust me, you don’t want that hassle while you’re in a foreign country and need quick care.

5. How to File a Claim When Abroad

Filing a claim abroad might sound scary, but it’s usually straightforward once you know the steps. First, always keep copies of all medical records and receipts from the hospital or clinic. Most insurance providers ask for a detailed description of your treatment, so be prepared to fill out some paperwork—yes, even in this digital age, paperwork still haunts us!

Make sure you contact your insurer as soon as something happens. They might need to pre-approve some treatments or give you directions on which hospitals are covered.

Pro tip: always have a copy of your insurance card and policy number saved on your phone (and backed up somewhere). It’s saved me more than once!

The Sum Up

Health insurance might not be the most exciting part of the digital nomad lifestyle, but it’s one of the most important.

Whether you’re planning short stints abroad or living a full-time nomad life, having the right health coverage will save you from a world of stress and financial pain. Before you head out on your next adventure, take a minute to assess your travel plans, your health needs, and make sure you’ve got a solid plan in place.

Now it’s your turn—if you’ve had any experiences with digital nomad health insurance, good or bad, drop them in the comments below! Safe travels and stay insured!